|

|

| Statutory Audit: |

| |

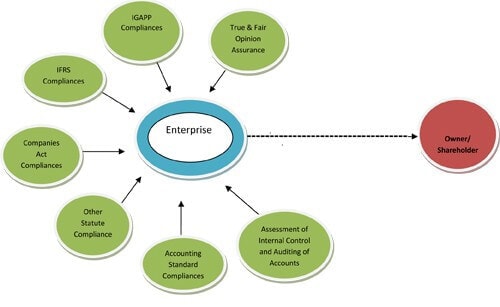

| Statutory Audit: In simple terms statutory audit in India is equated with Audit under the Companies Act. Every company incorporated under the companies act is required to get its accounts audited by a Chartered Accountant in Practice to ensure true and fair view of the accounts. Further, the auditor has to ensure compliance with various provisions of the Companies Act. Statutory Audit ensures reliability of annual accounts of the company for various consumers of Accounts of the Company like government, shareholders, debtors, creditors, bankers etc. |

| |

| The complexity of Statutory Audit Function has increased manifolds during recent times. Globalisation, Fast Changing Business and Statutory environment combined with need for synchronisation with various global accounting standards and ever increasing reliance on audited accounts by a variety of interested parties has put ever increasing responsibilities on the shoulders of any statutory auditor. |

| |

| How we can help: Our firm is well equipped and well experienced in Statutory Audit and we perform it as per the Audit Program designed for the company after assessment of their Internal Control. |

| |

|

| Steps generally we follow: |

- Getting Appointment Letter & Board Resolution Copy.

-

Getting NOC from Previous Auditor

-

Filing our no disqualification status to the company

-

Filing of Form 23B to ROC.

-

Getting Letter of Engagement

-

Assessment of Internal Control

-

Forming an opinion on financial statement prepared by the company

-

Reporting to Shareholders.

-

Attending AGM

|

| |